LCOS - Levelized Cost of Storage for energy technologies version 6.0 by Lazard utilizing the Enovation Analytics software platform and advisory .

Viewing entries tagged

Gabaldon

LCOS - Levelized Cost of Storage for energy technologies version 6.0 by Lazard utilizing the Enovation Analytics software platform and advisory .

LCOS - Levelized Cost of Storage for energy technologies version 4 by Lazard in collaboration with Enovation Partners.

Ancillary services – Frequency Regulation, in particular – has been critical to achieving desired hurdle rates among front-of-the-meter storage projects in deregulated markets. However, given finite size and price sensitivities in these markets, what will be the impacts for developers? We have extensive thoughts on the topic here at Enovation Partners, and, suffice to say, “the devil is in the details” when considering the answer.

The structure and rules of many ancillary service markets are complex, leading to unforeseen outcomes and disruptions when a new technology bursts on to the scene. If ancillary services products are configured with storage in mind (e.g. discharge duration, compensation for speed), there is a great fit with current storage capabilities.

However, markets are small:

Further obstacles to storage adoption come from each market’s complex pricing mechanism. In many cases, there is no simple price-setting mechanism in terms of supply/demand, and in other cases there is very little competition or price transparency.

PJM’s frequency regulation rules from 2012 encouraged a boom in storage, during which time owners and operators of storage benefitted from favorable market rules and compensation mechanisms (e.g. pay-for-performance). Commitment to net neutral signals for storage and limits on sustained signal durations leading to batteries acting out of harmony with system needs, and – at least from the Market Monitor’s perspective – overcompensation for Frequency Regulation resources following the Reg D signal.

In 2017, PJM changed its rules around neutral signals, signal intensity, and settlement mechanisms in a manner that left storage owners with significantly less revenue and, for some, substantially accelerated battery degradation. These rule changes were struck down after in an April 2018 ruling leading to a correction in pricing and signal. FERC has requested a technical conference for late 2018, and thus the wheel of time continues for PJM Reg D.

In New York, a potential state mandate of 1.5 GW of storage would create a market disconnect by injecting new, potentially uneconomic supply to meet a largely unchanging demand.

Frequency regulation market price declines by 90% following the installation of a 100 MW Tesla battery in South Australia - frequency regulation products were previously priced by units with highly volatile variable prices

We expect markets to struggle when there are swift changes to underlying technologies in a Regulation supply stack. Storage’s innate ability to provide ancillaries faster and cheaper than current price setting units will drive a step change in clearing prices as storage usurps gas-fired generation as the marginal unit.

At Enovation, we expect price drops to reflect the delta in the units’ marginal prices to provide ancillaries. As a result, market sensitivity to dramatic price changes in the near-future as storage projects could have dramatic implications for future development decisions by Independent Power Producers and investors. Prudent developers should have a clear idea of how additional market entry can impact pricing, and hedge by configuring systems to earn other revenue streams.

What does this mean for the economics of storage projects? How will overall storage penetration be affected? Are mandates achievable? Enovation Partners’ expertise and analytics capabilities guides our clients through issues like this everyday

Harnessing Predictive Analytics to do More with Less. Digital Gas Operations

Next generation DER has the potential to reshape energy usage and create substantial value in the C&I segment. Progress on costs and appropriate business models is promising. Barring surprises, we expect to see the segment take-off over the coming two to four years.

PV economics have improved rapidly, driving robust growth in PV penetration levels. Setting aside the potentially severe impacts of the imposition of steep tariffs on PV imports, we anticipate sustained growth.

More interestingly, we see the emergence of new business models. As subsidies fall and rate structures evolve, the emphasis is on using PV as part of an integrated energy source for C&I and municipal customers.

The focus is shifting from tax equity-based financing and origination (at any cost) to using PV to reduce the cost and risk of supply for C&I. Remote and virtual net metering, and more workable community solar business models are maturing rapidly.

About 100 MW of BTM storage has been installed in the U.S., and most of that is in California to help C&I customers reduce demand charges on their utility bills. At current costs, storage is generally attractive to C&I customers only in locations where demand charges in C&I tariffs are relatively high (>$15/kW-mo) – and even then, substantial incentives or policy mandates are usually also required to make a storage project viable.

Stacking of value streams from multiple revenue sources is essential, and in the case of PV and storage in California, potentially quite lucrative.

However, storage costs are falling rapidly, around 10% per year for the next several years. Moreover, other states (e.g., Massachusetts, Maryland, Nevada) are adopting policy mandates promoting storage. Combined with business model innovation, BTM storage will become economically appealing to C&I customers in many parts of the U.S. in five years – or less.

With low prices for natural gas and increasing efficiency of small-scale generation technologies, gas-fired DG is an attractive alternative to electricity in many U.S. markets, as evidenced by the emergence of specialized players such as Enchanted Rock and Tangent. As with storage, multiple value streams can be stacked to generate favorable returns for C&I customers – even in markets where PV and energy storage aren’t currently viable.

However, storage costs are falling rapidly, around 10% per year for the next several years. Moreover, other states (e.g., Massachusetts, Maryland, Nevada) are adopting policy mandates promoting storage. Combined with business model innovation, BTM storage will become economically appealing to C&I customers in many parts of the U.S. in five years – or less.

Although many C&I customers indicate interest in storage due to reliability concerns or desire to reduce environmental footprint, our research (survey of >400 customers, augmented by interviews) suggest that economic considerations far outweigh any other factor in deciding whether or not to employ DER.

Customer acquisition costs are high and sales cycles are lengthy, yet margins tend to be thin – especially today since many storage providers are pricing aggressively to enter the market. Owning and maintaining the customer relationship is essential for long-term success. Advanced analytics will be a critical source for unlocking value for customers, advanced software capabilities for monitoring optimization and control of DER; and load will become “table stakes.” Moreover, since C&I customers seek a materially lower total spend on energy, vendors that can offer an technologically agnostic array of solutions – including commodity – may be preferred.

Whether a C&I energy customer or a competitive or regulated supplier to the C&I market, a number of “no regrets” actions are worth beginning now in preparation for full take-off of C&I DER.

Rigorously analyze economics of alternative DER options for current and prospective C&I customers

Prioritize customer outreach efforts based on customer economics and predictors of propensity for DER

Establish competencies across DER technologies and associated product management functions

Organize around account managers to ensure single point-of-contact with customers, enabling optimal bundling of DER alternatives to maximize value

Integrate DER into load forecasting*, system design/ operation, and customer management strategy

Prepare regulatory strategy to benefit from increased DER adoption (e.g., decoupling, performance- based regulation)

StrengthenOpenInnovation capability to improve visibility on future DER developments

Understand real costs and performance of relevant DER options

Enhance organizational coordination to pool knowledge and resources, and align incentives concerning DER

Identify opportunities to profit from serving as a test-bed for DER technologies

Full Text PDF

Distributed Energy Resources (DER) is a primary focus area for Enovation Partners.

We have served a wide spectrum of clients – including many leading competitive energy providers and utilities, equipment OEMs, C&I energy buyers, and investors. We have also built proprietary analytical tools to support marketers, sales teams, product designers, and regulatory strategists. The following is a very brief summary of our observations on this rapidly evolving sector, and practical implications for potential market participants.

To learn more about our perspectives on C&I DER, please contact Dan Gabaldon.

* “Enovation Perspective” on this topic under development

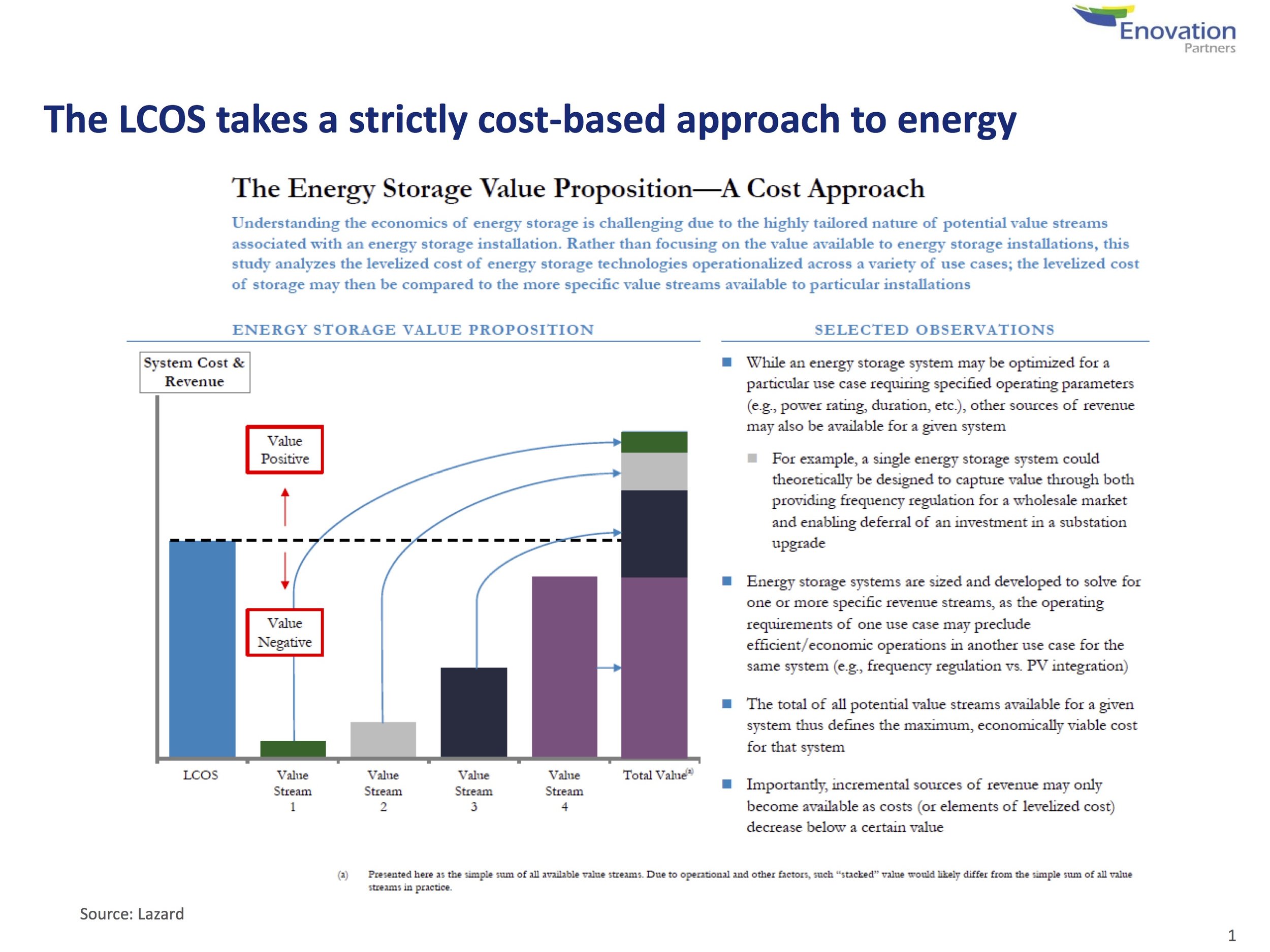

The Lazard Levelized Cost of Storage (LCOS) Survey is the most comprehensive survey of project costs in the industry, with over 120 companies participating last year.

As expected, the LCOS shows that costs are coming down across most technologies and use cases, with expectations for sustained cost reductions in the next few years. This is showcased through the continued cost reductions of lithium ion batteries, the introduction of promising new technologies such as flow batteries into commercial production, or the revitalization of existing technologies like lead through the adoption of carbon nanoparticles to enhance capability.

Cost reduction trends vary across technologies, highlighting a partial lack of standardization in costing and configurations. As we are still in the early commercial stage of technical development, these trends are expected to continue through improved material sourcing and manufacturing improvements. “Soft Costs” – deployment and operating expenses are expected to be significant areas of cost improvement going forward.

These falling costs hold the promise of opening up extensive new markets in the coming years – especially for the combined use cases that can greatly enhance the value of deployed storage assets.

Based on Enovation Partner’s current research into the C&I market, these cost reductions of storage assets are a key determinate for adoption. Based on a survey of 500 energy management decision makers, 20% of or respondents seriously considered adopting energy storage systems on site, but did not implement a deployment—with 80% citing economics being the dominant motivation for decisions.

For more information contact: Daniel Gabaldon

Dan Gabaldon's article in Power Engineering Magazine. The considerations necessary to evaluate new industrial energy storage

Lazard's LCOS 2.0 has been released. Enovation Partners collaborated with Lazard on the methodology and analysis.

DEFG and Enovation Partners Customer Surveys Point to Significant Impacts of Residential Solar on Utility Customer Service Strategy and Operations