LCOS - Levelized Cost of Storage for energy technologies version 6.0 by Lazard utilizing the Enovation Analytics software platform and advisory .

Viewing entries tagged

LCOS

LCOS - Levelized Cost of Storage for energy technologies version 6.0 by Lazard utilizing the Enovation Analytics software platform and advisory .

LCOS - Levelized Cost of Storage for energy technologies version 4 by Lazard in collaboration with Enovation Partners.

Overview of enhancements and modifications to the 3.0 version of Lazard's LCOS study

NEW YORK, December 15, 2016 – Lazard Ltd (NYSE: LAZ) has released its annual in-depth studies comparing the costs of energy from various generation technologies and of energy storage technologies for different applications.

Lazard’s latest annual Levelized Cost of Energy Analysis (LCOE 10.0) shows a continued decline in the cost of generating electricity from solar technology, with lesser cost declines in other forms of renewable energy. Lazard’s latest annual Levelized Cost of Storage Analysis (LCOS 2.0) shows cost declines in most battery storage technologies, but with wide variations depending on the type of application and battery technology.

In addition, LCOS 2.0, conducted with support from Enovation Partners, builds on the inaugural LCOS study conducted in 2015 with a refined methodology and the addition of new analysis that illustrates and compares the economics of “real-world” energy storage applications.

“Our studies continue to demonstrate that there are no one-size-fits-all solutions in energy generation or storage,” said George Bilicic, Vice Chairman and Global Head of Lazard’s Power, Energy & Infrastructure Group. “The demands of a developed economy will continue to require both traditional and alternative energy sources as the technologies driving renewable energy evolve.”

“The economic viability of commercial energy storage systems varies widely by application and on a regional basis,” said Jonathan Mir, Head of Lazard’s North American Power Group. “As manufacturers and customers identify optimal technologies for different use cases, we expect further innovation and a continued drop in costs, which will help drive increased use of renewables.”

The two studies offer a variety of insights, including the following selected highlights:

Lazard’s Global Power, Energy & Infrastructure Group serves private and public sector clients with advisory services regarding M&A, financing and other strategic matters. The group is active in all areas of the traditional and alternative energy industries, including regulated utilities, independent power producers, alternative energy and infrastructure.

About Lazard

Lazard, one of the world's preeminent financial advisory and asset management firms, operates from 42 cities across 27 countries in North America, Europe, Asia, Australia, Central and South America. With origins dating to 1848, the firm provides advice on mergers and acquisitions, strategic matters, restructuring and capital structure, capital raising and corporate finance, as well as asset management services to corporations, partnerships, institutions, governments and individuals. For more information on Lazard, please visit www.lazard.com

The Lazard annual report on the Levelized Cost of Storage LCOS 3.0 was released today with the Lazard Levelized Cost of Energy report LCOE 11.0

– LCOE 11.0 shows continued cost declines for utility-scale wind and solar energy –

– LCOS 3.0 shows declining but widely variable battery storage costs –

NEW YORK, November 2, 2017 – Lazard Ltd (NYSE: LAZ) has released its annual in-depth analyses comparing the costs of energy from various generation technologies and of energy storage technologies for different applications.

Lazard’s latest annual Levelized Cost of Energy Analysis (LCOE 11.0) shows a continued decline in the cost of generating electricity from alternative energy technologies, especially utility-scale solar and wind. Lazard’s latest annual Levelized Cost of Storage Analysis (LCOS 3.0), conducted with support from Enovation Partners, shows declining cost trends among commercially deployed technologies such as lithium-ion, but with wide variations depending on the type of application and battery technology.

“The growing cost-competitiveness of certain alternative energy technologies globally reflects a number of factors, including lower financing costs, declining capital expenditures per project, improving competencies and increased Industry competition,” said George Bilicic, Vice Chairman and Global Head of Lazard’s Power, Energy & Infrastructure Group.

“That said, developed economies will require diverse generation fleets to meet baseload generation needs for the foreseeable future.” “Energy industry participants remain confident in the future of renewables, with new alternative energy projects generating electricity at costs that are now at or below the marginal costs of some conventional generation,” said Jonathan Mir, Head of Lazard’s North American Power Group. “The next frontier is energy storage, where continued innovation and declining costs are expected to drive increased deployment of renewables, which in turn will create more demand for storage.”

The two studies offer a variety of insights, including the following selected highlights:

Lazard’s Global Power, Energy & Infrastructure Group serves private and public sector clients with advisory services regarding M&A, financing and other strategic matters. The group is active in all areas of 3 the traditional and alternative energy industries, including regulated utilities, independent power producers, alternative energy and infrastructure.

About Lazard

Lazard, one of the world's preeminent financial advisory and asset management firms, operates from 43 cities across 27 countries in North America, Europe, Asia, Australia, Central and South America. With origins dating to 1848, the firm provides advice on mergers and acquisitions, strategic matters, restructuring and capital structure, capital raising and corporate finance, as well as asset management services to corporations, partnerships, institutions, governments and individuals.

For more information on Lazard, please visit www.lazard.com. Follow us at @Lazard.

Link to source: Lazard Press Release for LCOS 3.0

Industry leading analytical comparison of energy storage costs

The Lazard Levelized Cost of Storage (LCOS) Survey is the most comprehensive survey of project costs in the industry, with over 120 companies participating last year.

As expected, the LCOS shows that costs are coming down across most technologies and use cases, with expectations for sustained cost reductions in the next few years. This is showcased through the continued cost reductions of lithium ion batteries, the introduction of promising new technologies such as flow batteries into commercial production, or the revitalization of existing technologies like lead through the adoption of carbon nanoparticles to enhance capability.

Cost reduction trends vary across technologies, highlighting a partial lack of standardization in costing and configurations. As we are still in the early commercial stage of technical development, these trends are expected to continue through improved material sourcing and manufacturing improvements. “Soft Costs” – deployment and operating expenses are expected to be significant areas of cost improvement going forward.

These falling costs hold the promise of opening up extensive new markets in the coming years – especially for the combined use cases that can greatly enhance the value of deployed storage assets.

Based on Enovation Partner’s current research into the C&I market, these cost reductions of storage assets are a key determinate for adoption. Based on a survey of 500 energy management decision makers, 20% of or respondents seriously considered adopting energy storage systems on site, but did not implement a deployment—with 80% citing economics being the dominant motivation for decisions.

For more information contact: Daniel Gabaldon

Dan Gabaldon's article in Power Engineering Magazine. The considerations necessary to evaluate new industrial energy storage

Lazard's LCOS 2.0 has been released. Enovation Partners collaborated with Lazard on the methodology and analysis.

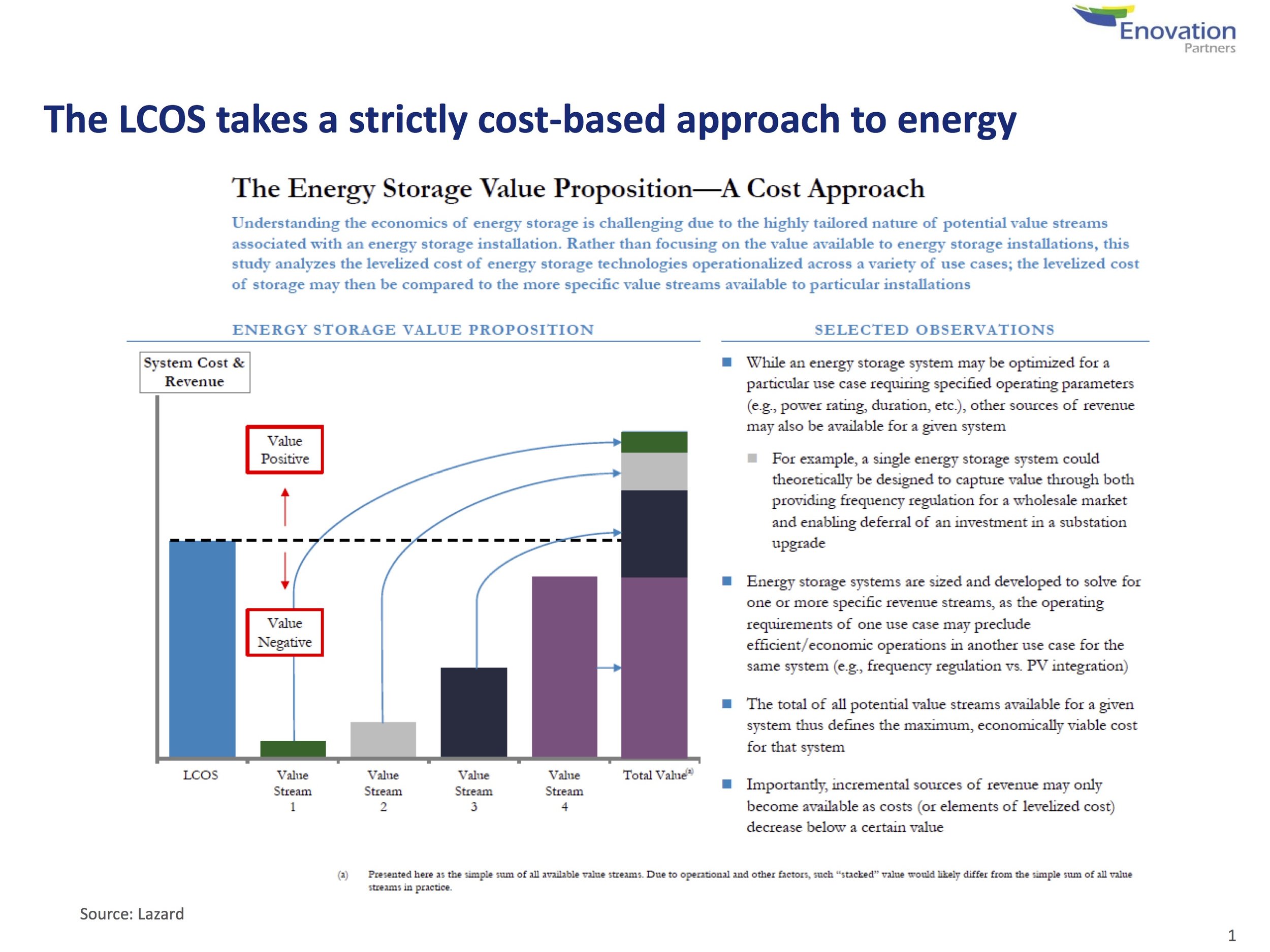

The first substantial comparison of energy storage costs, technologies, and applications - "Levelized Cost of Storage Analysis" was released on November 18th by investment bank Lazard. The groundbreaking study was developed in consultation and partnership with Enovation Partners.